Sage Intacct has built in functionality to recognize project revenue, but a customer needed a custom process to recognize project expenses. There is no native equivalent for this in Intacct, so the proposed solution was to build a custom application that would check the expenses posted to temporary clearing account and generate recognition entries for them.

For the sake of consistency, the customer decided to use the custom process for both revenue and expense, foregoing the standard process in Intacct.

The items and transaction definitions are configured to post to the clearing accounts, instead of actual expense or revenue account. Each item has custom fields to specify the target revenue and expense accounts that are to be used when recognizing the revenue/expense. All recognition is done on the GL level, thus automatically covering any transaction type in Intacct that posts to GL.

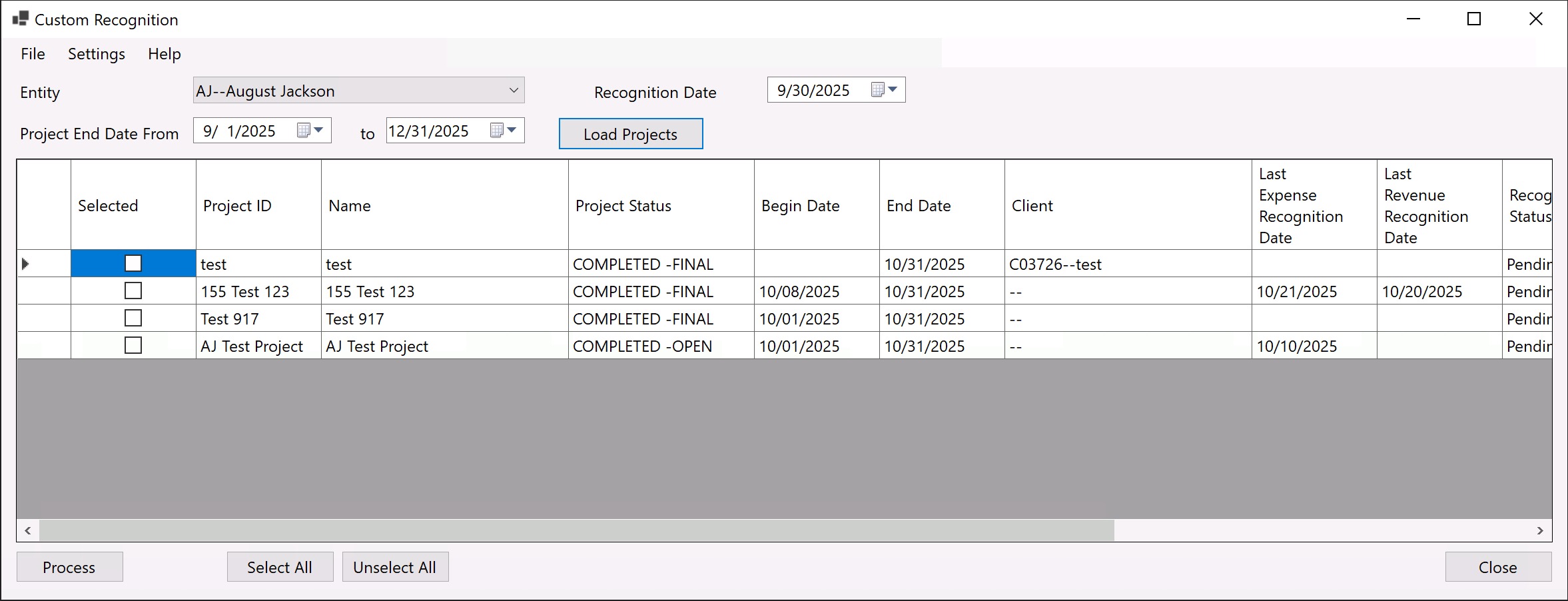

For the sake of keeping the costs down, it was decided to develop this process as a Windows desktop application, so there would not be any hosting or recurring fees. Here is how the application looks.

One entity is processed at a time and user selects the projects by a range of end dates. From the list of matching projects, user can select/unselect individual projects and click a button to recognize the accumulated expenses or revenues. The process remembers which transactions have already been recognized, so the next time it runs, it only includes the new transactions in the recognition.

Leave a Reply

You must be logged in to post a comment.